Businesses operating vehicle fleets face relentless pressure to reduce operating costs while improving control, security, and reporting. Fuel cards deliver a powerful solution by driving down fuel expenses and enhancing management oversight. For companies like , adopting optimized fleet fuel card programs translates into measurable financial and operational advantages.

Fuel Cards Slash Fuel Costs Through Targeted Discounts and Rebates

Fleet fuel cards provide access to negotiated fuel discounts at thousands of fueling stations, often reducing per-gallon costs significantly. For example, fuel card users can save up to 6 cents per gallon at participating locations, with volume-based rebates providing even greater savings. Over the course of a year, a mid-sized fleet consuming 200,000 gallons could see savings exceeding $12,000, not including additional rebate tiers or regional advantages.

Data from the U.S. Energy Information Administration shows that average retail gasoline prices can vary by over 20% between states. By using fuel cards with dynamic discount networks, fleets can mitigate these cost variances through location-optimized pricing strategies. Additionally, many programs include bulk fuel purchase agreements, giving larger fleets direct access to wholesale pricing opportunities.

These cards are accepted at over 95% of U.S. fuel stations, offering drivers route flexibility without sacrificing savings. Unlike traditional credit cards, which charge standard retail prices and high processing fees, fleet fuel cards are tailored to commercial usage, supporting business-specific fuel economy, secure transactions, and insightful data integration.

Enhanced Spending Control Reduces Waste and Fraud

Fuel fraud can consume up to 10% of a fleet’s annual fuel budget. A report by Automotive Fleet magazine notes that misuse and theft account for over $1 billion in lost fuel annually across U.S. commercial operations. Fuel cards counteract this with rigorous control features, including driver-specific PINs, real-time alerts, and the ability to restrict transactions by location, time of day, and fuel type. These tools eliminate unauthorized purchases and significantly reduce the risk of fraud, especially in large or dispersed fleets.

Advanced fuel cards allow administrators to set dynamic spending limits, segment purchasing rights by job roles, and deactivate cards instantly. These purchase controls form a crucial barrier against abuse, improving security while empowering managers to proactively enforce policy. Compatibility with accounting software adds another layer of efficiency, streamlining expense tracking and ensuring data consistency across departments.

According to a 2023 survey by , companies that implement spending controls see a 15% average reduction in fuel-related overspending within the first 90 days of adoption.

Automated Reporting and Analytics Streamline Expense Management

Manual receipt tracking and spreadsheet logging are outdated and inefficient. Fleet cards replace these practices with automated digital reporting, which records every transaction in real time. Integrated reporting solutions, often available via app or dashboard, enable finance and operations teams to monitor fuel expenses, flag outliers, and reconcile statements effortlessly.

Detailed analytics uncover trends in vehicle fuel efficiency, highlight underperforming drivers, and inform cost-saving route adjustments. With tools like GPS and telematics integration, companies gain visibility into fuel usage patterns, engine idling, and route deviation, directly tying vehicle behavior to operational costs.

Research from Fleet Management Weekly shows that fleets using integrated reporting tools identify 17% more cost-saving opportunities compared to non-integrated peers. These features also enable accurate fuel reimbursement tracking and performance-based driver assessments, supporting broader fleet management goals and compliance initiatives.

Fleet Fuel Cards Improve Operational Efficiency Across the Board

The use of fuel cards translates to significant labor and administrative cost reductions. Automating the expense reporting process saves up to 10 hours per month per admin team member. This equates to a 30% drop in administrative costs while improving the accuracy of financial data.

A McKinsey & Company study found that digitized expense tools can reduce invoice processing time by up to 65% and error rates by over 20%. Additionally, companies gain from centralized billing and improved cash flow. Unlike credit cards, which have rigid billing cycles, many fleet cards allow customizable payment structures, including net billing and consolidated invoicing. This enhances budgeting precision and offers insight into fuel usage per vehicle, driver, or region.

Integration capabilities extend the impact of fuel cards beyond the pump. Fuel card programs support API connectivity with ERP systems, enabling seamless transaction uploads, eliminating manual entries, and increasing audit-readiness. With average invoice processing costs dropping from $9 to under $3 with automation, these integrations offer quantifiable ROI.

Choosing the Right Card Maximizes Business Impact

Not all fuel cards are created equal. and similar businesses should prioritize cards that match operational needs, including station compatibility, reporting features, and integration with existing accounting systems.

The Fleet Card and FlexCard offer broad U.S. acceptance, granular data reporting, and seamless integration with most ERP and accounting platforms. These cards are particularly valuable for industries such as HVAC, construction, and logistics, where route predictability and heavy vehicle use demand reliable and secure fueling solutions.

When evaluating providers, businesses should also consider:

Fuel network size and acceptance: Cards should be accepted at major fuel chains and truck stops

Fee structures: Avoid hidden costs by selecting transparent programs with capped or waived fees for high usage

Support tools: Real-time alerts, mobile app access, and responsive customer service drive user satisfaction

Customization options: Spending limits, user controls, and vehicle-level reporting are essential for tailored oversight

Real-World Application: and Fuel Savings

For companies in the energy and logistics sectors, like , the ability to monitor fuel expenses across widespread locations is essential. Fuel cards provide the convenience and control needed to manage large-scale operations without increasing administrative burden. With detailed usage tracking, can enforce spending controls across hundreds of locations, ensuring consistent policy adherence and optimizing fuel economy per gallon.

’s internal cost analysis showed a 12% reduction in fuel expenses within the first year of implementing a national fleet fuel card program. Fleet managers also reported a 40% decrease in fuel fraud incidents due to PIN protection and purchase controls.

Integration Enhances Value Beyond the Pump

Fuel cards’ true value lies in their integration with broader fleet management tools. When combined with telematics, maintenance scheduling, and driver monitoring systems, they become central to fleet optimization strategies.

By tying fuel transactions to GPS and telematics data, companies uncover insights on idle time, unauthorized stops, and inefficiencies. This holistic approach leads to measurable improvements in vehicle utilization and fuel efficiency.

According to Frost & Sullivan, fleets integrating telematics with fuel card systems can reduce overall fuel consumption by 8% to 12%, translating into substantial savings across even small to mid-sized vehicle networks.

Some providers offer API integration to sync card data with ERP and accounting systems. This eliminates manual data entry, enhances compliance, and improves audit readiness-key benefits for growing businesses managing expanding fleets.

Strategic Cost Control in a Volatile Market

With national fuel prices fluctuating unpredictably, businesses must find stable and scalable cost-control methods. Fuel cards provide insulation from market shocks by leveraging fixed discount programs, strategic rebates, and consumption analytics.

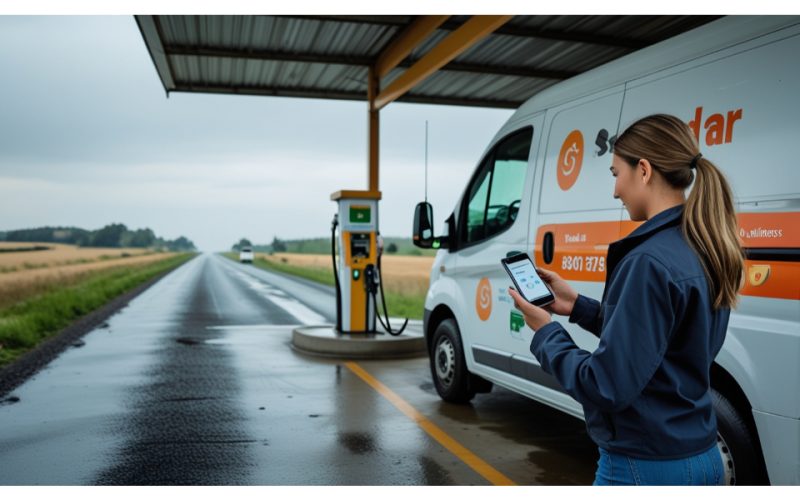

Fuel cards also support energy transition goals. As more fleets adopt EVs, providers are expanding coverage to include EV charging stations, allowing for unified tracking across vehicle types. This future-ready model supports long-term operational sustainability while maximizing immediate cost savings.

Market forecasts from Deloitte indicate that mixed fuel fleets-including EV, diesel, and gas vehicles-will dominate U.S. commercial operations by 2030. Fleet fuel card solutions that evolve alongside this trend will be critical to maintaining financial control and regulatory compliance.

Unlock Fleet Efficiency and Savings with Fuel Cards

Fuel cards are indispensable for businesses seeking to reduce fuel costs, control spending, and streamline fleet management. By leveraging real-time data, customizable controls, and national station access, companies like can improve their bottom line while enhancing driver compliance and administrative efficiency.

Investing in fleet fuel card solutions like the a fleet card equips businesses with the tools to thrive in a competitive market. From reporting accuracy to fraud prevention and strategic integration, fuel cards are a cost-saving, data-driven asset that transforms vehicle operations.

Ready to optimize your fleet’s fuel expenses? Explore how fuel card solutions can deliver unmatched savings and operational control for your business today.